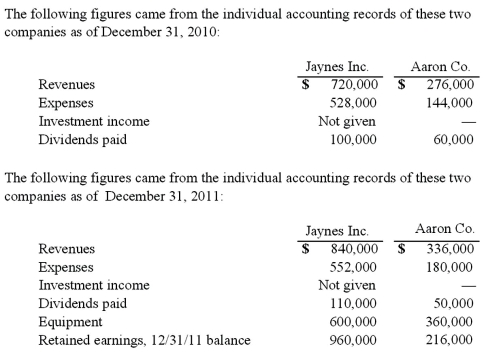

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.  What was consolidated equipment as of December 31, 2011?

What was consolidated equipment as of December 31, 2011?

Definitions:

Contract Law

The body of law governing the formation, execution, and enforcement of contracts between parties.

Fair Bargain

A deal or agreement that is considered equitable and satisfactory to all parties involved.

Full Satisfaction

The complete fulfillment of an obligation or payment in a manner that fully satisfies the terms agreed upon.

Debt

An obligation owed by one party, the borrower, to a second party, the lender; typically involving borrowed money that is expected to be paid back with interest.

Q3: To foster interest in reading,help children focus

Q5: Strickland Company sells inventory to its parent,

Q8: Aristotle was a person who stuttered.

Q11: The three components of language include<br>A)Competence,performance and

Q17: When should an investor not use the

Q36: Wilson owned equipment with an estimated life

Q46: Jans Inc. acquired all of the outstanding

Q51: The financial balances for the Atwood Company

Q88: Denber Co. acquired 60% of the common

Q102: Perch Co. acquired 80% of the common