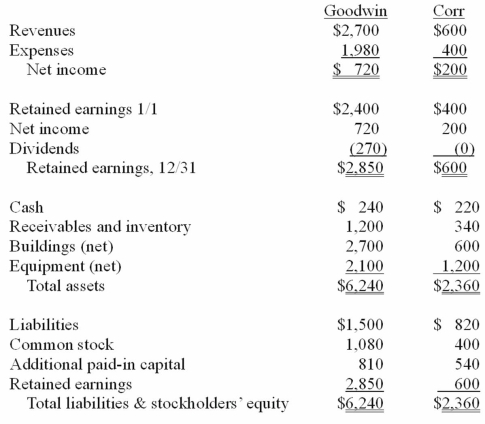

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated revenues for 20X1.

Definitions:

Perfectly Competitive Market

A market structure characterized by a large number of buyers and sellers, homogeneous products, and easy entry and exit, leading to price-taking behavior.

Variable Costs

Costs that vary directly with the level of output or business activity, such as materials and labor.

Revenues

The total income produced by a company from its activities, before any expenses are subtracted.

Long-run Supply Curve

A graphical representation that shows the relationship between the price of a good and the quantity supplied over a period long enough for producers to adjust all of their inputs.

Q1: Excessive interruptions of speech increase stuttering.

Q7: Approximately 10% of the population present with

Q19: Students from culturally and linguistically diverse backgrounds

Q21: Kaye Company acquired 100% of Fiore Company

Q46: Jans Inc. acquired all of the outstanding

Q48: On January 1, 2010, Smeder Company, an

Q49: The financial balances for the Atwood Company

Q105: The following information has been taken from

Q111: On January 1, 2011, Bangle Company purchased

Q118: Perry Company acquires 100% of the stock