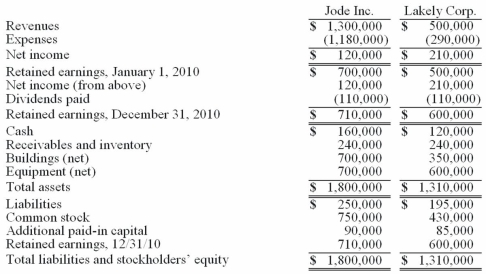

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2010, follow. Lakely's buildings were undervalued on its financial records by $60,000.  On December 31, 2010, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

On December 31, 2010, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Required:

Determine consolidated net income for the year ended December 31, 2010.

Definitions:

Stock Price

The current market price at which a share of a company's stock can be bought or sold.

Profitability

A measure of how effectively a company generates profit compared to its revenue. It's an indicator of financial health and efficiency.

Chief Executive Officer

The highest-ranking executive in a company, responsible for making major corporate decisions, managing overall operations, and acting as the main point of communication between the board of directors and corporate operations.

Interest Rates

For the use of assets, lenders apply a charge to borrowers, expressed as a proportion of the principal.

Q1: Excessive interruptions of speech increase stuttering.

Q5: It's true that the hearing loss belongs

Q5: Thomas Inc. had the following stockholders' equity

Q7: The most frequently occurring type of cerebral

Q10: Genes<br>A)A set of 46 rod-like structures in

Q10: One company acquires another company in a

Q19: Listeners should say 'slow down' to persons

Q38: The financial statements for Goodwin, Inc., and

Q77: Cayman Inc. bought 30% of Maya Company

Q301: Characteristics that distinguish emerging adulthood from other