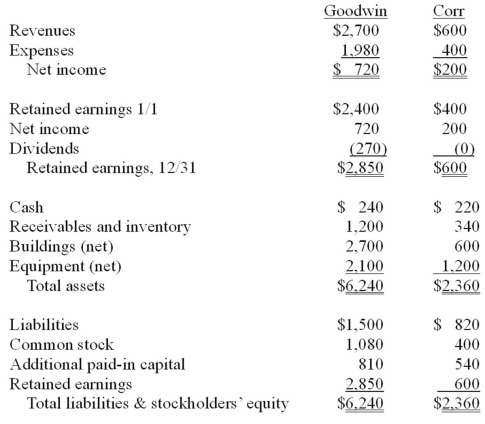

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated buildings (net) account at December 31, 20X1.

Definitions:

Program Outcomes

The results or impacts that a specific program aims to achieve measured by specific indicators.

Evidence-based

Practices or decisions that are grounded on the most current and rigorous scientific research.

Face Validity

The extent to which a test or assessment appears effective in terms of its stated aims to those taking or observing it.

Frequency, Intensity, Duration

Metrics used to describe and assess the characteristics of an event or activity, particularly in contexts like exercise, therapy, and research.

Q1: On January 4, 2010, Harley, Inc. acquired

Q11: There is a reciprocal relationship between oral

Q13: A primary role of speech-language pathologists is

Q17: When consolidating a subsidiary that was acquired

Q19: Students from culturally and linguistically diverse backgrounds

Q34: What would differ between a statement of

Q59: The financial balances for the Atwood Company

Q75: On January 4, 2011, Mason Co. purchased

Q91: On January 1, 2011, Deuce Inc. acquired

Q127: Stark Company, a 90% owned subsidiary of