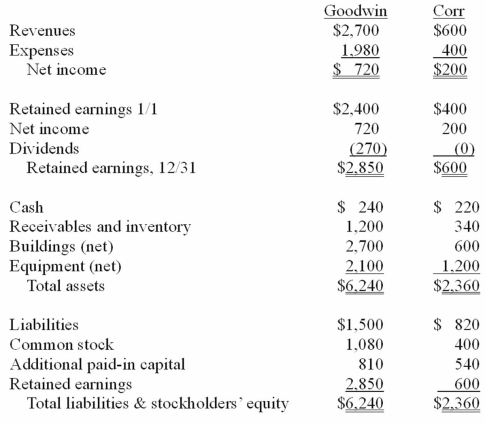

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consideration transferred for this acquisition at December 31, 20X1.

Definitions:

Ergonomics

An interdisciplinary approach to designing equipment and systems that can be easily and efficiently used by human beings.

Psychological Aggression

Hostile social interaction or behavior that involves mental or emotional harm rather than physical.

Work Performance

The assessment of an employee's effectiveness in fulfilling job responsibilities and tasks.

Drug Testing

The process of using medical or technical methods to determine whether a person has used the drug substances.

Q5: Two -year old Matthew has a severe

Q9: Similarities and differences exist within and among

Q14: Membership in the National Student Speech-Language-Hearing Association

Q18: When comparing the difference between an upstream

Q19: On January 1, 2010, Franel Co. acquired

Q47: Pell Company acquires 80% of Demers Company

Q80: Gargiulo Company, a 90% owned subsidiary of

Q81: Perry Company acquires 100% of the stock

Q119: On 4/1/09, Sey Mold Corporation acquired 100%

Q124: Patti Company owns 80% of the common