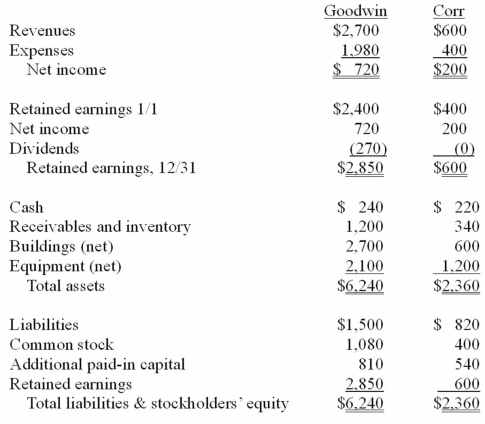

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated common stock account at December 31, 20X1.

Definitions:

Perfect Correlation

A statistical relationship indicating a flawless direct or inverse linkage between two variables.

Matched Design

A research design that matches the experimental participants with control participants who are similar on key characteristics.

Epidemiological

Relating to the study of how disease rates vary among different population groups to identify patterns, causes, and control health problems.

Experimental

Referring to a method of investigation in the sciences and social sciences in which variables are manipulated to observe and measure effects on a particular outcome.

Q4: In response to the request "Find the

Q12: Cayman Inc. bought 30% of Maya Company

Q13: Carnes has the following account balances as

Q21: Jet Corp. acquired all of the outstanding

Q33: On January 1, 2010, Palk Corp. and

Q61: How are direct combination costs, contingent consideration,

Q75: Flynn acquires 100 percent of the outstanding

Q79: Pell Company acquires 80% of Demers Company

Q83: Bauerly Co. owned 70% of the voting

Q88: What is the justification for the timing