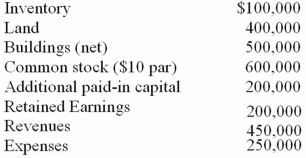

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

Definitions:

Outstanding Balance

This term refers to the amount of money owed on a loan or credit account that has not yet been repaid.

Cheque

A written, dated, and signed instrument that directs a bank to pay a specific sum of money to the bearer.

Invoice

A document indicating the sale transaction and requesting payment for goods or services provided.

ROG

Receipt of Goods, a term used in supply chain management and accounting to denote the time at which goods are received, which may trigger payment or recording processes.

Q11: Phonological disorders may be characterized by severe

Q13: Under the partial equity method of accounting

Q15: Language assessment guides language intervention.

Q16: Three and a half year-old Julie loves

Q52: McGuire Company acquired 90 percent of Hogan

Q66: During 2010, Von Co. sold inventory to

Q74: Harrison, Inc. acquires 100% of the voting

Q78: Stiller Company, an 80% owned subsidiary of

Q88: Watkins, Inc. acquires all of the outstanding

Q118: On January 3, 2011, Jenkins Corp. acquired