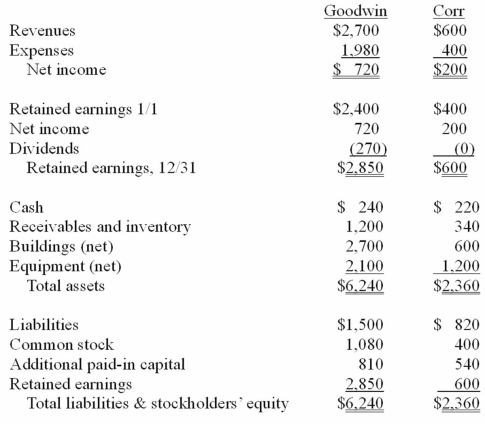

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated additional paid-in capital at December 31, 20X1.

Definitions:

Marginal Cost

The investment required to manufacture an extra unit of a good or service.

Mineral Water

Water that contains minerals or other dissolved substances that alter its taste or give it therapeutic value, usually obtained from wells or springs.

Demand Curve

A graphical representation showing the relationship between the price of a good and the quantity demanded by consumers.

Marginal Cost

The added cost of producing one additional unit of a product or service.

Q1: Language<br>A)Is a synonym for communication<br>B)Is a conventional

Q9: Four-year old Carrie presented with moderate breathy

Q12: There is also a child on your

Q14: On January 1, 2010, Mehan, Incorporated purchased

Q18: On January 4, 2010, Harley, Inc. acquired

Q23: Gargiulo Company, a 90% owned subsidiary of

Q66: Perch Co. acquired 80% of the common

Q88: What is the justification for the timing

Q91: Pepe, Incorporated acquired 60% of Devin Company

Q97: Utah Inc. acquired all of the outstanding