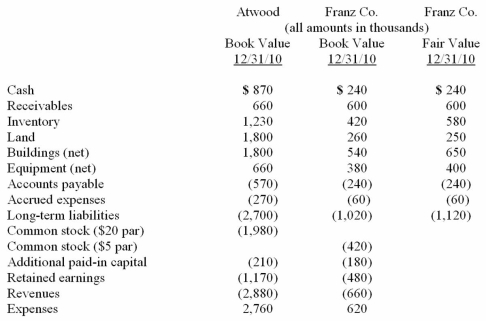

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute the investment to be recorded at date of acquisition.

Definitions:

DSM-5 Criteria

The diagnostic criteria for mental disorders as outlined in the fifth edition of the Diagnostic and Statistical Manual of Mental Disorders, used by healthcare professionals.

Antisocial Personality Disorder

A long-standing mental condition defined by consistent neglect of or violation against others' rights.

Psychopathy

A disorder of the personality typified by ongoing antisocial actions, a lack of empathy and regret, along with daring, unrestrained, and self-centered characteristics.

Antisocial Personality Disorder

A psychological state where an individual persistently disregards moral standards and is indifferent to the rights and emotions of other people.

Q5: The speech-language pathologist plans her language assessment

Q7: J has ALS.He requires an AAC system

Q8: During speech production,which suggests<br>A)The movement of the

Q13: Otololaryngologists prescribe and dispense hearing aids.

Q26: On January 1, 20X1, the Moody Company

Q30: Strickland Company sells inventory to its parent,

Q45: How does the existence of a non-controlling

Q45: On January 1, 2011, Anderson Company purchased

Q50: Pell Company acquires 80% of Demers Company

Q88: Denber Co. acquired 60% of the common