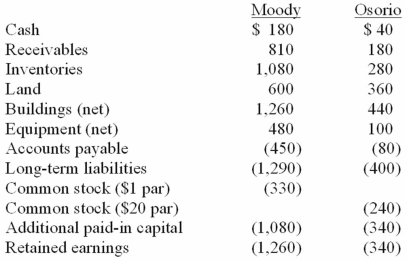

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Capitalism

An economic system characterized by private ownership of the means of production and the creation of goods or services for profit.

Self-Interest

The motivation of individuals to pursue their own advantages and well-being.

Price Ceilings

Price controls that outlaw trade at prices above the ceiling.

Intended

Something that is planned or meant to happen in a specific way.

Q4: Why do intra-entity transfers between the component

Q5: Thomas Inc. had the following stockholders' equity

Q5: The percentage of voice disorders among the

Q9: Fesler Inc. acquired all of the outstanding

Q10: Genes<br>A)A set of 46 rod-like structures in

Q13: The laryngeal system<br>A)Shapes air stream into speech

Q39: On January 4, 2010, Harley, Inc. acquired

Q56: Which of the following internal record-keeping methods

Q56: Stark Company, a 90% owned subsidiary of

Q85: How does the partial equity method differ