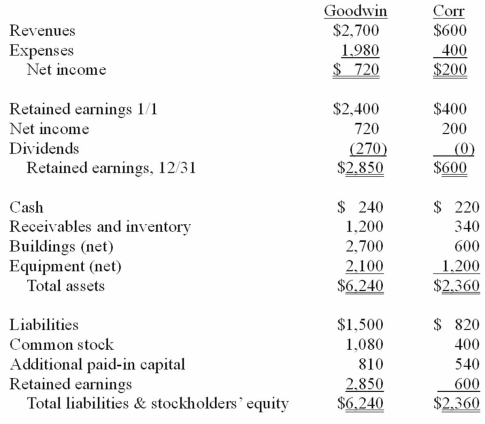

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated retained earnings at December 31, 20X1.

Definitions:

Foreign Operation

A subsidiary, associate, joint venture, or branch of a company that is located in a country different from the one where the parent company operates.

Presentation Currency

The currency in which a company's financial statements are presented.

Non-Monetary Items

Assets or liabilities that are not easily quantified in monetary terms, such as goodwill, patents, or real estate.

Functional Currency

The currency of the primary economic environment in which the company predominantly generates and expends cash.

Q8: Syndrome<br>A)A recognizable pattern of abnormalities that indicate

Q10: On November 8, 2011, Power Corp. sold

Q11: The majority of voice disorders are preventable.

Q16: McGuire Company acquired 90 percent of Hogan

Q21: Communication breakdowns among school-age children with language

Q68: Dodge, Incorporated acquires 15% of Gates Corporation

Q75: Flynn acquires 100 percent of the outstanding

Q79: On January 1, 2011, Musial Corp. sold

Q94: MacHeath Inc. bought 60% of the outstanding

Q98: On January 1, 2009, Rand Corp. issued