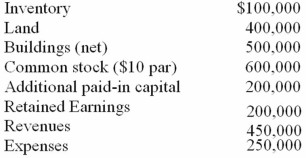

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. On May 1, 2010, what value is assigned to Riley's investment account?

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. On May 1, 2010, what value is assigned to Riley's investment account?

Definitions:

Enforceable Agreement

A contract or agreement that is legally binding and can be upheld or compelled by law.

Title of Goods

A formal documentation or legal term indicating ownership rights over goods.

Express Contract

A contract explicitly stated by the parties, either orally or in writing, detailing the terms clearly.

Contract Formed

refers to the creation of a legally binding agreement that arises when an offer by one party is accepted by another party, meeting the necessary legal requirements.

Q7: Cynthia is a 19 year-old budding actress.Six

Q8: When working with special populations such as

Q9: Research and clinical evidence suggests that therapy

Q12: Cayman Inc. bought 30% of Maya Company

Q15: Audiologists and speech-language pathologists work in educational

Q39: Describe the accounting for direct costs, indirect

Q98: The financial statements for Jode Inc. and

Q102: Which one of the following varies between

Q109: Wilson owned equipment with an estimated life

Q117: What is the difference in consolidated results