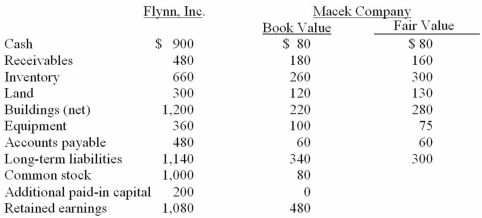

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 20X1. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs. The book values for both Flynn and Macek as of January 1, 20X1 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.  What amount will be reported for consolidated receivables?

What amount will be reported for consolidated receivables?

Definitions:

Current Liabilities

Short-term financial obligations that are due to be paid within one year, such as accounts payable, short-term loans, and taxes owed.

Accounts Receivable Turnover

A measure of the liquidity of accounts receivable; computed by dividing net credit sales by average net accounts receivable.

Net Credit Sales

The total amount of sales made on credit, minus any returns or allowances.

Accounts Receivable

Amounts owed to a company by its customers for goods or services delivered on credit.

Q2: Direct treatment for dysphagia involves the use

Q7: Several years ago Polar Inc. acquired an

Q16: McGuire Company acquired 90 percent of Hogan

Q18: Goehler, Inc. acquires all of the voting

Q24: Acker Inc. bought 40% of Howell Co.

Q27: Watkins, Inc. acquires all of the outstanding

Q43: Pritchett Company recently acquired three businesses, recognizing

Q60: Following are selected accounts for Green Corporation

Q111: Flynn acquires 100 percent of the outstanding

Q112: On January 4, 2011, Mason Co. purchased