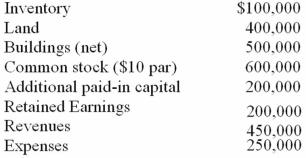

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. What will be the consolidated additional paid-in capital as a result of this acquisition?

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. What will be the consolidated additional paid-in capital as a result of this acquisition?

Definitions:

Analysis

The process of breaking down complex data or situations into simpler parts to understand them better.

Decision

A conclusion or resolution reached after consideration, often rendered by a court or judicial body.

Appellate Opinions

Judicial decisions or written explanations by appellate courts regarding the resolution of appeals.

Errors

Mistakes or inaccuracies in a process, document, or action that can lead to misunderstandings or problems if not corrected.

Q3: Pepe, Incorporated acquired 60% of Devin Company

Q3: Peterman Co. owns 55% of Samson Co.

Q4: Because Amy exhibits VPI,her speech is most

Q7: J has ALS.He requires an AAC system

Q15: Gargiulo Company, a 90% owned subsidiary of

Q16: The quality of voice cannot be completely

Q17: Children with developmental language delay often produce

Q63: Steven Company owns 40% of the outstanding

Q72: On January 1, 2011, Pride, Inc. acquired

Q72: Atlarge Inc. owns 30% of the outstanding