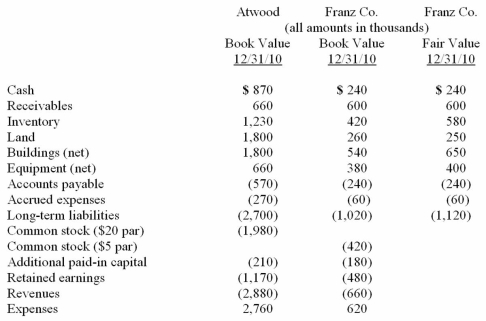

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated retained earnings as a result of this acquisition.

Definitions:

Thalamus

A brain structure that acts as a relay station for sensory and motor signals to the cerebral cortex, playing a key role in processing sensory information.

Reticular Formation

A network of neurons located in the brainstem that plays a key role in controlling arousal and alertness.

Midbrain

A central part of the brainstem that plays an important role in visual and auditory processing and motor control.

Hindbrain

The posterior portion of the brain that includes structures such as the cerebellum, pons, and medulla oblongata, responsible for regulating basic life functions like breathing, heart rate, and balance.

Q7: In planning Hakim's intervention,the speech-language pathologist decides

Q7: Approximately 10% of the population present with

Q8: Recently,pharmacological treatments have proven efficacious for aphasia

Q8: Syndrome<br>A)A recognizable pattern of abnormalities that indicate

Q11: Factors that should be considered in determining

Q14: Shaun's hypernasality most likely results from<br>A)Dyskinesia<br>B)Velopharyngeal competency<br>C)Velopharyngeal

Q45: Pepe, Incorporated acquired 60% of Devin Company

Q64: Patti Company owns 80% of the common

Q72: On January 1, 2011, Pride, Inc. acquired

Q81: On January 1, 2010, Dawson, Incorporated, paid