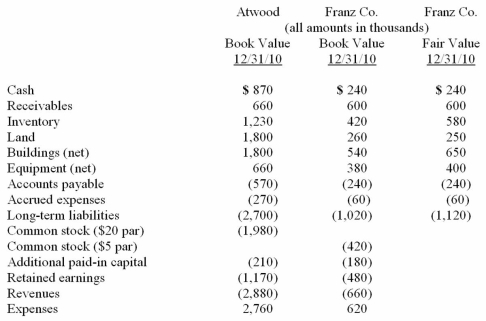

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated inventory at date of acquisition.

Definitions:

Tribal Children

Children born into and raised within indigenous tribal communities, often with distinct cultural, social, and linguistic traditions.

Nonschooled Children

Children who do not receive formal education through traditional schooling systems, including both those who are homeschooled and those who receive no schooling.

Organizational Strategies

Organizational Strategies are methods or approaches used to structure, arrange, and manage information, tasks, or physical spaces efficiently.

Liberian Children

Refers to the young population of Liberia, a country in West Africa, emphasizing aspects of their growth, development, culture, or challenges.

Q2: Hospital-based audiologists may not only conduct universal

Q10: Scott's test results suggest a<br>A)Conductive hearing loss<br>B)Sensorineural

Q13: The speech-language pathologist states that her patient

Q17: Phonological processes<br>A)Are rules for combining individual speech

Q20: Which of the following statements is false

Q59: On January 1, 2010, Smeder Company, an

Q63: Steven Company owns 40% of the outstanding

Q73: Which one of the following is a

Q75: Flynn acquires 100 percent of the outstanding

Q93: Prior to being united in a business