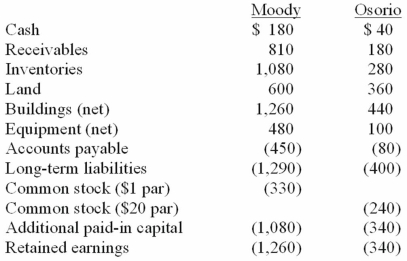

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

External Incentive

A motivation or stimulus originating from outside an individual that influences their behavior or actions.

Behavioral Change

Modifications or transformations in human actions or reactions due to various factors such as learning, therapy, or life experiences.

Conditioned Reinforcer

A stimulus that gains its reinforcing power through its association with a primary reinforcer; often used in behavior modification and conditioning.

Operant Conditioning

A method of learning that employs rewards and punishments for behavior, which affects the likelihood of certain behaviors being repeated.

Q9: Research and clinical evidence suggests that therapy

Q12: Culture and ethnicity do not play a

Q15: Language assessment guides language intervention.

Q15: The financial balances for the Atwood Company

Q16: One role of the speech-language pathologist is

Q16: Speech-language pathologists and audiologists may consult with

Q20: The purpose of communication for persons with

Q38: Perry Company acquires 100% of the stock

Q57: Cashen Co. paid $2,400,000 to acquire all

Q118: Perry Company acquires 100% of the stock