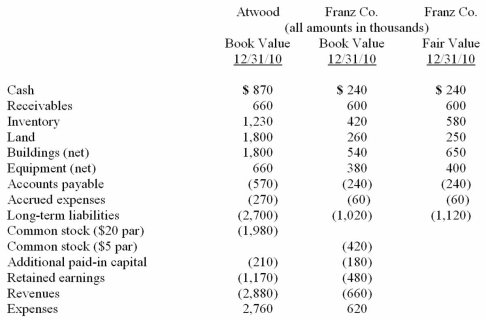

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated land at date of acquisition.

Definitions:

Justice

A principle of fairness or moral rightness that dictates the equitable treatment of all individuals within a society.

Accountability

The duty of a person or entity to justify their actions, take accountability for those actions, and reveal the outcomes in a clear way.

Ethical Principle

Fundamental guidelines that help determine the rightness or wrongness of actions within a professional or societal context.

Fidelity

The degree of accuracy and exactness with which something is copied or reproduced, or loyalty and faithfulness to commitments and obligations.

Q7: Standardized tests may give the inaccurate impression

Q8: Stark Company, a 90% owned subsidiary of

Q10: Scott's test results suggest a<br>A)Conductive hearing loss<br>B)Sensorineural

Q11: Communication difference<br>A)Normal language patterns that vary from

Q15: Nasal air emission and hypernasality produce identical

Q19: Patients with sensorineural hearing loss are considered

Q46: Jans Inc. acquired all of the outstanding

Q56: Which of the following internal record-keeping methods

Q79: Ryan Company owns 80% of Chase Company.

Q115: Renfroe, Inc. acquires 10% of Stanley Corporation