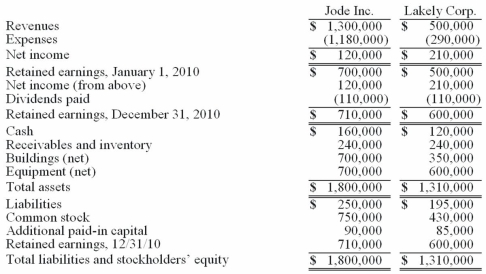

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2010, follow. Lakely's buildings were undervalued on its financial records by $60,000.  On December 31, 2010, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

On December 31, 2010, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Prepare the journal entries to record (1) the issuance of stock by Jode and (2) the payment of the combination costs.

Definitions:

Muscle Cells

Specialized cells that make up muscle tissue, capable of contracting to produce movement in parts of the body.

Cardiac Muscle

A type of striated muscle found exclusively in the heart, responsible for pumping blood throughout the body.

Intercalated Discs

Specialized structures in cardiac muscle cells that facilitate the synchronized contraction of the heart through electrical coupling between cells.

Fibers

Fibers are long, thin strands of material, often found in textiles or dietary content, known for their strength, flexibility, or nutritional value.

Q5: Goodwill is often acquired as part of

Q7: Spontaneous recovery refers to the return of

Q13: Edgar Co. acquired 60% of Stendall Co.

Q19: On January 1, 2010, Franel Co. acquired

Q29: Stiller Company, an 80% owned subsidiary of

Q38: The financial statements for Goodwin, Inc., and

Q43: Pritchett Company recently acquired three businesses, recognizing

Q73: Dodge, Incorporated acquires 15% of Gates Corporation

Q88: Watkins, Inc. acquires all of the outstanding

Q117: Yukon Co. acquired 75% percent of the