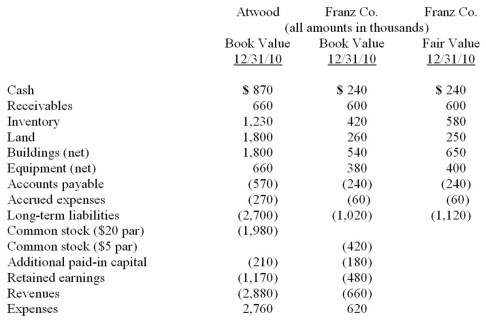

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated expenses at date of acquisition.

Definitions:

D-Altrose

A rare aldohexose sugar, a stereoisomer of D-glucose, found in its d-form.

L-Altrose

An aldohexose sugar that is a stereoisomer of the more common glucose, rarely found in nature.

Fischer Projection

A method of drawing organic molecules as a two-dimensional representation that allows visualization of the three-dimensional arrangement of substituents around chiral centers.

D-Erythrose

D-Erythrose is a four-carbon sugar (tetrose) with the chemical formula C4H8O4, known for being one of the simplest aldose carbohydrates.

Q4: Genetics<br>A)A branch of biological science that examines

Q10: Six year old Brian has cerebral palsy

Q37: Walsh Company sells inventory to its subsidiary,

Q43: Walsh Company sells inventory to its subsidiary,

Q59: Pell Company acquires 80% of Demers Company

Q77: What is the impact on the non-controlling

Q79: Luffman Inc. owns 30% of Bruce Inc.

Q99: On January 1, 2010, Cale Corp. paid

Q107: Using the acquisition method for a business

Q119: On 4/1/09, Sey Mold Corporation acquired 100%