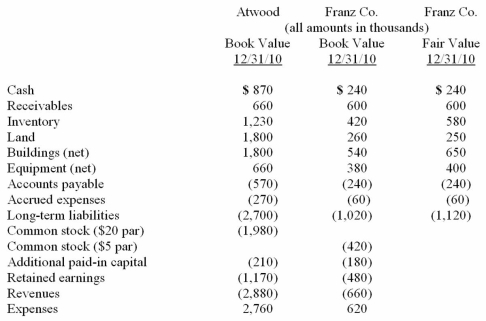

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated goodwill at date of acquisition.

Definitions:

Population Variances

Population variances measure the degree to which each number in a set differs from the mean of the population, showing the spread or dispersion within the set.

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is true.

Chi-Squared Distribution

A probability distribution widely used in statistical hypothesis tests, particularly in tests of independence and goodness of fit.

Degrees of Freedom

The number of independent values or quantities which can be assigned to a statistical distribution, necessary for calculating statistics like variances.

Q4: Linda can analyze printed words into sound

Q7: Audiometers emit pure tones used for quantitative

Q13: Carnes has the following account balances as

Q13: The speech-language pathologist states that her patient

Q16: Emily's speech is very unintelligible.Her mother understands

Q23: Gargiulo Company, a 90% owned subsidiary of

Q45: One company acquires another company in a

Q49: The financial balances for the Atwood Company

Q85: Idler Co. has an investment in Cowl

Q113: McGuire Company acquired 90 percent of Hogan