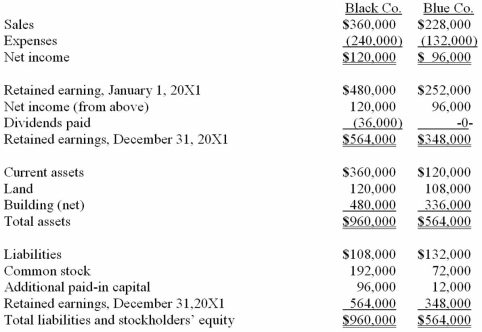

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 20X1.  On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 20X1 assuming the transaction is treated as a purchase combination.

Definitions:

Money Multiplier

A factor that quantifies the amount of additional money that can be created in a bank's lending process for a given amount of reserves.

Excess Reserves

Excess reserves are the capital reserves held by a bank or financial institution in excess of what is required by regulators, central bank, or other financial authority.

Opportunity Cost

Missing out on potential opportunities from different choices when opting for a single alternative.

Holding Money

The act of keeping money in cash or in very liquid assets to facilitate transactions or as a precaution against uncertainties.

Q2: Gomez is 69-years old and bilingual.She suffered

Q12: Beatty, Inc. acquires 100% of the voting

Q13: Surgical repair of a cleft palate is

Q17: John performs poorly on tasks of word

Q25: Watkins, Inc. acquires all of the outstanding

Q38: Keefe, Inc., a calendar-year corporation, acquires 70%

Q39: On January 1, 2010, Glenville Co. acquired

Q62: On April 7, 2011, Pate Corp. sold

Q94: MacHeath Inc. bought 60% of the outstanding

Q119: When applying the equity method, how is