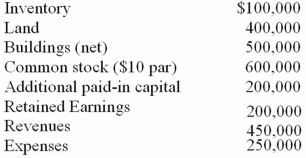

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

Definitions:

Q2: An acquisition transaction results in $90,000 of

Q14: Hakim's educational team decides that it is

Q15: Laurie has normal hearing; however,her air conduction

Q18: Swallowing may be viewed as a patterned,programmed

Q19: Listeners should say 'slow down' to persons

Q36: On January 4, 2011, Bailey Corp. purchased

Q43: A parent company owns a controlling interest

Q77: Pell Company acquires 80% of Demers Company

Q78: All of the following would require use

Q91: The financial statements for Goodwin, Inc., and