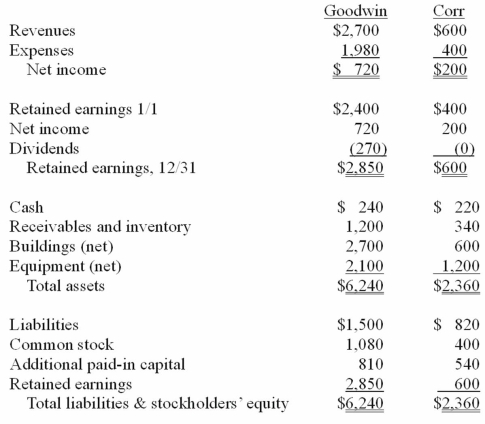

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated receivables and inventory for 20X1.

Definitions:

Deep Vein Thrombosis

A blood clot that forms in a deep vein, usually in the legs, which can become life-threatening if it dislodges and travels to the lungs.

Mobile Compression Device

A portable device used to apply pressure to limbs to enhance circulation and prevent blood clots.

D-Dimer

A blood test that measures a substance released when a blood clot dissolves; it's used to help diagnose or rule out thrombosis.

Osteoporosis

A medical condition characterized by the weakening of bones, making them fragile and more likely to break.

Q4: The terms accent and dialect may be

Q9: How would a change be made from

Q32: Why is push-down accounting a popular internal

Q53: When is a goodwill impairment loss recognized?<br>A)

Q65: When Jolt Co. acquired 75% of the

Q70: Denber Co. acquired 60% of the common

Q98: On January 1, 2009, Rand Corp. issued

Q101: Webb Co. acquired 100% of Rand Inc.

Q112: Gargiulo Company, a 90% owned subsidiary of

Q115: Pell Company acquires 80% of Demers Company