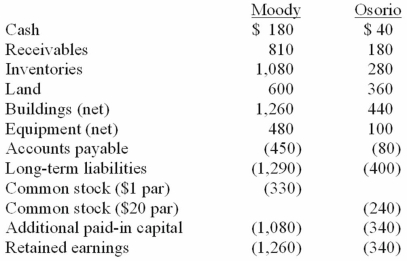

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Active Processing

The mental manipulation of information to retain it in short-term memory, integrate it into long-term memory, or solve problems.

Peterson and Peterson

Researchers known for their work on the duration of short-term memory, especially the experiment demonstrating rapid forgetting without rehearsal.

Rehearsal

A practice session in preparation for a public performance (as of a play or speech) or procedure.

Chunking

Chunking is a process of breaking down larger pieces of information into more manageable, smaller units, making it easier to remember and process.

Q2: Sociolinguistics<br>A)The study of language acquisition<br>B)The study of

Q7: Parents begin to attribute meaning to their

Q12: Accent<br>A)Phonological and vocal characteristics of a spoken

Q16: Bradley's AAC system was designed to allow

Q17: Bilingual individuals control parts or all of

Q19: Pell Company acquires 80% of Demers Company

Q56: Presented below are the financial balances for

Q58: Caldwell Inc. acquired 65% of Club Corp.

Q87: On January 1, 2010, Smeder Company, an

Q112: Gargiulo Company, a 90% owned subsidiary of