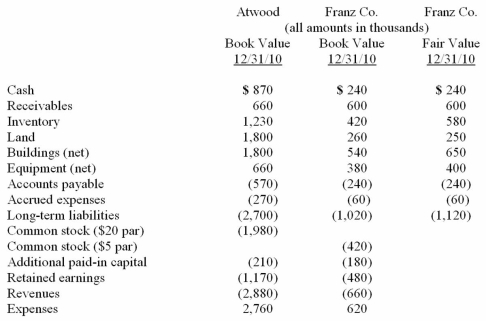

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated buildings (net) at date of acquisition.

Definitions:

Single Entity

A business or organization that is legally recognized as a single unit, distinct from its owners or shareholders.

Exporting

The act of sending goods or services to another country for sale.

Foreign Markets

Markets outside the domestic borders where companies can expand their operations and sales.

Q3: Shaun's speech is unintelligible.All aspects of his

Q5: Gene expression refers to the passing on

Q13: Stimulability refers to<br>A)How easily the client can

Q15: Gargiulo Company, a 90% owned subsidiary of

Q29: Which of the following is false regarding

Q40: Jaynes Inc. acquired all of Aaron Co.'s

Q72: On January 1, 2011, John Doe Enterprises

Q73: Yules Co. acquired Noel Co. in an

Q79: Luffman Inc. owns 30% of Bruce Inc.

Q117: On January 1, 2011, Jackie Corp. purchased