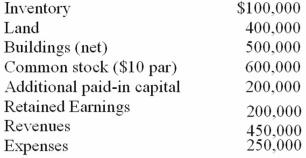

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. What will be Riley's balance in its common stock account as a result of this acquisition?

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. What will be Riley's balance in its common stock account as a result of this acquisition?

Definitions:

Specialty Product

A product that is characterized by its unique attributes, high level of quality, or brand identity, often leading consumers to put forth a significant effort in purchasing it.

Supplies

Materials or items used in the operation of a business or needed to provide services.

Unsought Product

Products that consumers do not actively seek out to buy, and may purchase only out of necessity or unforeseen need, such as emergency services or life insurance.

Shopping Products

Goods for which consumers will spend time and effort to compare quality, price, and perhaps style between different sellers before making a purchase.

Q1: Walsh Company sells inventory to its subsidiary,

Q10: Researchers decide to determine the prevalence of

Q11: Scanning selection methods are preferable for individuals

Q11: Pot Co. holds 90% of the common

Q15: Lisa is three years old.Her speech is

Q17: On January 1, 2009, Nichols Company acquired

Q37: On January 1, 2011, Harrison Corporation spent

Q66: During 2010, Von Co. sold inventory to

Q86: How are stock issuance costs accounted for

Q96: On January 1, 2011, Harrison Corporation spent