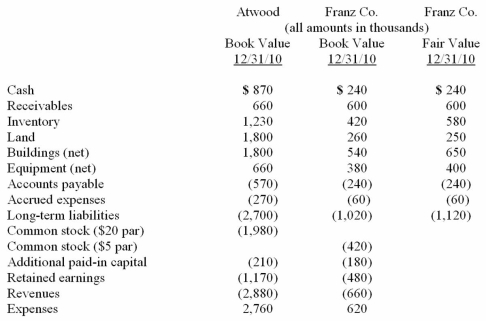

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute the investment to be recorded at date of acquisition.

Definitions:

Ledger

A book or digital record where financial transactions are entered, tracking the changes in each account associated with those transactions.

Trial Balance

An accounting report that lists the balances of all general ledger accounts at a particular point in time, used to ensure debits equal credits.

Debt Ratio

A financial ratio that measures the extent of a company's leverage, calculated as total liabilities divided by total assets.

Bookkeeping

Bookkeeping is the process of recording daily transactions in a consistent way, and is a key part of maintaining accurate financial records for a business.

Q6: Group treatment for patients with aphasia is

Q7: Caregiver-infant interactions important to language development include<br>A)Joint

Q8: Justin exhibits poor vocabulary comprehension,poor sentence recall

Q17: Auditory localization is the ability to identify

Q18: Many hospitals have a newborn hearing screening

Q50: Which of the following is a not

Q57: Chain Co. owned all of the voting

Q69: Walsh Company sells inventory to its subsidiary,

Q95: McGuire Company acquired 90 percent of Hogan

Q108: Fargus Corporation owned 51% of the voting