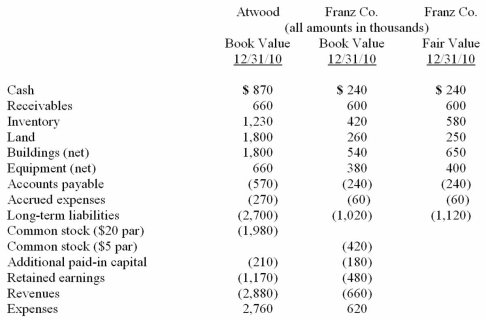

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated land at date of acquisition.

Definitions:

Journal Entries

Entries made in the bookkeeping system of a business to record financial transactions, including details of debits and credits involved.

Gourmet Foods

High-quality or exotic ingredients and prepared foods that are often more costly and sought after for their unique flavors and presentation.

Merchandisers

Merchandisers are businesses or individuals that purchase goods for the purpose of selling them to consumers at a profit.

Year-End Adjustments

Year-end adjustments are accounting entries made at the end of an accounting period to update accounts for accurate financial reporting.

Q5: Bradley's communication goals include increasing functional use

Q12: Ideograms are real life pictures to be

Q14: The vocal pitch of men is generally

Q18: The language students encounter in school is

Q29: Stiller Company, an 80% owned subsidiary of

Q32: When a parent uses the equity method

Q35: Tara Company owns 80 percent of the

Q52: In a transaction accounted for using the

Q59: On January 1, 2010, Smeder Company, an

Q83: Pell Company acquires 80% of Demers Company