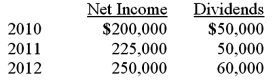

On January 1, 2010, Mehan, Incorporated purchased 15,000 shares of Cook Company for $150,000 giving Mehan a 15% ownership of Cook. On January 1, 2011 Mehan purchased an additional 25,000 shares (25%) of Cook for $300,000. This last purchase gave Mehan the ability to apply significant influence over Cook. The book value of Cook on January 1, 2010, was $1,000,000. The book value of Cook on January 1, 2011, was $1,150,000. Any excess of cost over book value for this second transaction is assigned to a database and amortized over five years. Cook reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout the years:  On April 1, 2012, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

On April 1, 2012, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

How much of Cook's net income did Mehan report for the year 2012?

Definitions:

Predetermined Overhead Rate

A rate calculated before the accounting period begins, used to allocate manufacturing overhead costs to products based on a selected activity base.

Manufacturing Overhead

All manufacturing costs that are not directly tied to the production of goods, such as rent, utilities, and salaries of maintenance personnel.

Total Manufacturing Cost

The aggregate of all costs directly attributable to the production of goods, including material, labor, and overhead costs.

Schedule of Cost

A detailed listing of all costs, both fixed and variable, associated with producing a good or delivering a service.

Q6: Joseph smoked two packs of cigarettes a

Q15: Aphasiologists and experts in stuttering define the

Q17: Children with language disorders will acquire literacy

Q40: Jaynes Inc. acquired all of Aaron Co.'s

Q41: How would you determine the amount of

Q75: Watkins, Inc. acquires all of the outstanding

Q77: Pell Company acquires 80% of Demers Company

Q84: Flynn acquires 100 percent of the outstanding

Q87: On January 1, 2010, Smeder Company, an

Q244: At what age does cardiac output reach