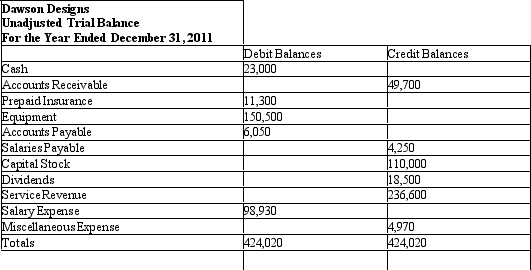

Below is the unadjusted trial balance for Dawson Designs at December 31,2011 - the end of its first year in business.

(1)Identify the errors in the following trial balance.All accounts have normal balances.

(2)Prepare a corrected trial balance.

Definitions:

Tax Paid

The amount of money that has been handed over to governmental entities as required by tax laws, based on earnings, sales, property values, etc.

Marginal Tax Rates

The rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your next dollar of taxable income.

Interest Income

Revenue earned from investments in interest-bearing financial instruments, such as bonds, savings accounts, or loans.

Eligible Dividends

Dividends that are qualified for special tax treatment under certain jurisdictions.

Q26: The balance sheet accounts are referred to

Q59: For the year ending June 30,Island Clinical

Q79: Which of the following is an example

Q115: Deferrals are recorded transactions that delay the

Q130: Organize the following accounts into the usual

Q133: Given below are the accounts and amounts

Q133: Depreciation on Office Equipment is $3,300.The adjusting

Q145: The buyer will include the sales tax

Q157: Bob Evans owns a business,Beachside Realty,that rents

Q157: Listed below are accounts to use for