Analyzing costs in an engineering company.On June 1,XEON Engineering,which oversees the

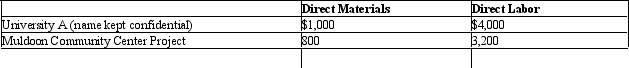

cleanup of asbestos condemned buildings,had two jobs in process with the following costs incurred to date:

In addition,overhead is applied to these jobs at the rate of 100 percent of direct labor costs.

As of June 1,XEON had incurred direct materials costs as shown in the table,mostly for laboratory testing materials.

During June,XEON completed both jobs and recorded them as Cost of Goods Sold.

The University A job required no more direct materials in June,but it did require $1,200 of direct labor to complete.The Muldoon Community Center Project job required $400 of direct materials and $2,000 of direct labor to complete.

XEON started a new job,Sea Breeze Elementary Project,during June and put $1,600 of direct labor costs into this job and $400 of direct materials.The Sea Breeze Project has not been completed as of the end of June.

Required: Provide the cost of direct materials,direct labor,and overhead (at 150 percent of direct labor cost)for the three jobs.

Definitions:

Arthritis

A general term for conditions that involve pain and inflammation in the joints.

Overreactive Immune System

A condition where the immune system responds too strongly to a stimulus, potentially causing harm to the body, as seen in allergies and autoimmune diseases.

Emotion-focused Coping

A type of stress management that involves reducing the emotional impact of stress by seeking to change the way one feels about or perceives a problem.

Optimistic Outlook

An attitude or mindset that tends to expect the most favorable outcomes or dwell on the most hopeful aspects of a situation.

Q1: EVA encourages the right kind of behavior

Q4: Which of the following prestigious,internationally renowned awards

Q8: Marlow Company<br>The following information pertains to the

Q12: What is the difference between price and

Q36: Which of the following statements is true

Q48: Which of the following is the performance

Q76: Break-even time.Weldon Company's research and development department

Q89: What are the strategic and operational uses

Q92: Which of the following is a reason

Q98: In managerial accounting,what is the cost of