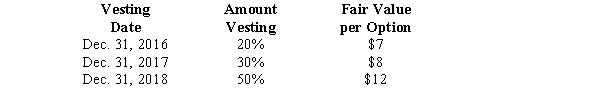

Red Company is a calendar-year U.S.firm with operations in several countries.At January 1,2016,the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25.The vesting schedule is 20% the first year,30% the second year,and 50% the third year (graded-vesting) .The fair value of the options is estimated as follows:

What is the compensation expense related to the options to be recorded in 2017?

Definitions:

Stimulus Discrimination

The ability of an individual to differentiate between similar stimuli and respond to them differently.

Selective Retention

The psychological process by which individuals remember information that is consistent with their beliefs and attitudes while forgetting or ignoring contradictory information.

Routine Problem Solving

The use of simple, habitual decision-making strategies in buying situations that are familiar and not considered to be of high importance.

Behavioral Learning

Behavioral learning theory suggests that learning is the result of conditioning, where behavior is shaped through reinforcement or punishment, leading to a change in behavior patterns.

Q22: Cal Cookie Company (CCC)has 100 million shares

Q29: Gabriel Company views share buybacks as treasury

Q53: The estimated medical costs are expected to

Q58: Which of the following is not a

Q66: Which is the correct entry to record

Q70: Which of the following statements are more

Q79: ZIP Company owns 40,000 shares of the

Q88: External financial statements<br>A)promote internal management planning and

Q118: Partial balance sheets and additional information are

Q118: If executive stock options or restricted stock