The following information comes from the 2013 Occidental Petroleum Corporation annual report to shareholders:

NOTE 4 INVENTORIES

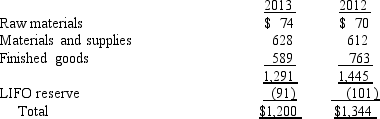

Net carrying values of inventories valued under the LIFO method were approximately $205 million and $185 million at December 31,2013 and 2012,respectively.Inventories consisted of the following: ($ in millions)

The LIFO reserve indicates that inventories would have been $91 million and 101 million higher at the end of 2013 and 2012,respectively,if Occidental Petroleum had used FIFO to value its entire inventory.

Required:

If Occidental Petroleum had used FIFO to value its entire inventory how would its 2013 pre-tax income be affected?

Definitions:

Q4: LIFO liquidation profits occur when inventory quantity

Q19: Listed below are five terms followed by

Q28: Hulkster's 2016 inventory turnover is (rounded):<br>A)3.62.<br>B)3.96.<br>C)4.07.<br>D)6.03.

Q59: Losses on reduction to NRV may be

Q61: Important elements of an internal control system

Q62: According to International Financial Reporting Standards (IFRS),property,plant,and

Q87: In a periodic inventory system,the cost of

Q89: In a perpetual average cost system:<br>A)A new

Q111: Which of the following is not an

Q129: Calistoga's 2016 bad debt expense is:<br>A)$1,720.<br>B)$1,650.<br>C)$1,505.<br>D)$1,575.