Use the following to answer questions

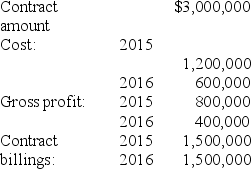

Sahara Desert Homes (SDH) reports under IFRS and constructed a new subdivision during 2015 and 2016 under contract with Cactus Development Co.Relevant data are summarized below:

SDH uses the cost recovery method under IFRS to recognize revenue.

SDH uses the cost recovery method under IFRS to recognize revenue.

-In its December 31,2015,balance sheet,SDH would report:

Definitions:

Operating Activities

Activities directly related to the operating aspect of a business, such as selling products, managing costs, and paying salaries.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life.

Operating Activities

Business functions directly related to providing goods or services, such as sales, production, and day-to-day administration.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the asset’s consumption or wear and tear.

Q27: Listed below are 5 terms followed by

Q43: The FASB is currently the public-sector organization

Q51: Adjusting entries are primarily needed for:<br>A)Cash basis

Q65: Kline's 12/31/16 total current liabilities:

Q71: Compared to the accrual basis of accounting,the

Q91: Listed below are five terms followed by

Q112: On December 31,2015,Coolwear,Inc.had a balance in its

Q274: If the seller is an agent,the seller

Q291: Hulkster's 2016 average collection period is:<br>A)73 days.<br>B)104

Q294: Rothbart Manufacturing agrees to manufacture bumper cars