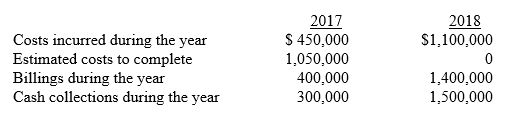

Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,800,000. The project was begun in 2017 and completed in 2018. Cost and other data are presented below:

-Assume that Beavis recognizes revenue upon completion of the project.

Required:

Prepare all journal entries to record costs, billings, collections, and profit recognition.

Definitions:

Temporal Method

An accounting technique for converting the financial statements of a subsidiary in a foreign currency into the parent company's reporting currency.

Retained Earnings

Profits that a company retains at the end of a fiscal period, which are not distributed to shareholders as dividends but are reinvested in the business.

Remeasured

The process of adjusting the book value of a foreign currency transaction on the financial statements to reflect the current exchange rate.

Depreciation Expense

An accounting method used to allocate the cost of a tangible asset over its useful life, reflecting wear and tear, deterioration, or obsolescence.

Q8: Accrual accounting attempts to measure revenues and

Q34: Loan C has the same principal amount,payment

Q46: Briefly explain how a company that recognized

Q76: Kline's 2016 net income (or loss):

Q88: The balance sheet reports a company's financial

Q123: A company is effectively leveraging when:<br>A)The return

Q124: When converting an income statement from a

Q153: Briefly explain why the direct write-off of

Q297: Required: Compute the asset turnover ratio for

Q319: Beck Construction Company began work on a