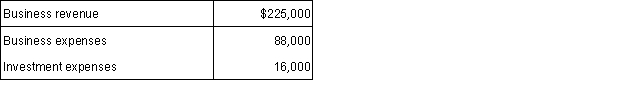

Owen and Jessica own and operate an S corporation. Each is a 50% owner. The business reports the following results:  How do Owen and Jessica report these items for tax purposes?

How do Owen and Jessica report these items for tax purposes?

Definitions:

Statute of Frauds

A legal principle requiring certain types of contracts (e.g., real estate transactions, contracts not to be performed within one year) to be in writing to be enforceable.

Partially Performed

A term referring to a contract or agreement that has been started but not fully executed or completed.

Intended To Be Bound

A principle indicating that parties involved in an agreement wish and intend to be legally obligated under that agreement.

Void

Lacking legal validity or effect; something that is null and cannot produce any legal consequences.

Q4: During 2015, Sam paid the following taxes:

Q9: If Section 1231 losses exceed Section 1231

Q25: The adjusted basis of an asset is:<br>A)

Q29: Which of the following miscellaneous itemized deductions

Q41: DJ is age 27, single, and reported

Q47: What are the criteria that determine an

Q66: Patrice sells a parcel of land for

Q71: Tamiko buys a painting from a collector

Q74: When calculating self-employment taxes from a taxpayer

Q105: In general, the basis of property purchased