Essay

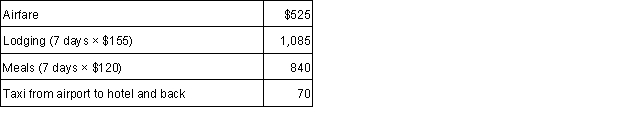

Terry, a CPA, flew from Dallas to New York to attend a conference. The conference lasted four days. Then she took three days of vacation to go sightseeing. Terry's expenses for the trip are as follows:  Calculate Terry's travel expense deduction.

Calculate Terry's travel expense deduction.

Definitions:

Related Questions

Q7: Flow-through entities include, but are not limited

Q11: The exclusion for dependent care assistance plans

Q14: A taxpayer purchased land in 2008 for

Q17: Which of the following is not considered

Q38: The tax liability for a married couple

Q47: What are the criteria that determine an

Q65: On June 1<sup>st</sup> of the current year,

Q70: Failure to furnish a correct TIN to

Q71: If a taxpayer materially participates in his/her

Q78: Often, individuals who purchase a home with