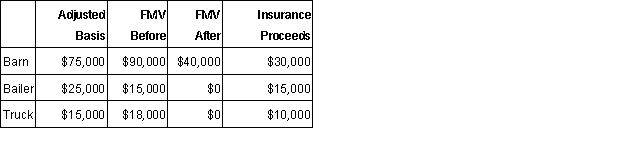

Alan owns a ranch in Kansas. During the year, a tornado damaged one of his barns and destroyed some equipment. The following information provides the details of the losses Alan suffered from the tornado.  How much loss from the tornado can he deduct on his tax return for the current year?

How much loss from the tornado can he deduct on his tax return for the current year?

Definitions:

Serotonin

A neurotransmitter in the brain that is involved in the regulation of mood, appetite, and sleep, among other functions.

Carbohydrates

Organic compounds, including sugars, starches, and cellulose, which are a major source of energy for the body.

Basal Metabolic Rate

The amount of energy per unit time that a person needs to maintain the functioning of their body at rest.

Set Point

A theory suggesting that an individual's body weight is maintained around a biologically predetermined point.

Q15: What is the limit on the social

Q46: A taxpayer can qualify for head of

Q48: The basic standard deduction in 2015 for

Q48: Arin and Bo have $74,000 total taxable

Q50: Molly is single with AGI of $22,500.

Q51: If a taxpayer is covered by Medicare,

Q55: Flow-through entities supply each owner at the

Q57: K. Kruse Designs has the following employees:

Q62: Banks and credit unions report interest income

Q75: Taxpayers can claim a child tax credit