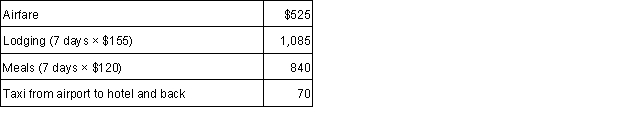

Terry, a CPA, flew from Dallas to New York to attend a conference. The conference lasted four days. Then she took three days of vacation to go sightseeing. Terry's expenses for the trip are as follows:  Calculate Terry's travel expense deduction.

Calculate Terry's travel expense deduction.

Definitions:

Minor

An individual under the age of legal adulthood, typically under 18, who has limited legal rights and capacities.

Voidable Title

A title to property or goods that can be rendered null and void due to certain conditions, such as fraud or misrepresentation.

Good Faith Purchaser

is a person who buys property without notice of any other party's claim to the title of the property and for a fair value.

Consequential Damages

Losses that arise not directly from a breach of contract but as a foreseeable result of the breach.

Q3: Some charitable contributions are limited to 50%

Q5: Gloria resides in a state that imposes

Q8: Taxable income (TI) is computed after subtracting

Q26: What is meant by a passive activity?

Q37: Which of the following expenses is deductible,

Q37: For a qualifying relative to be claimed

Q72: A head of household taxpayer with a

Q94: Short-term capital losses first reduce 28% gains,

Q97: Which of the following interest expenses incurred

Q119: Norman received shares of stock as a