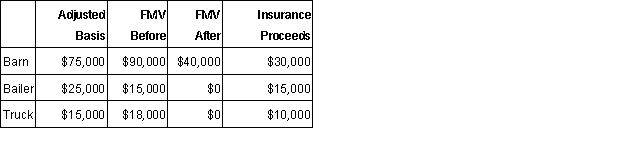

Alan owns a ranch in Kansas. During the year, a tornado damaged one of his barns and destroyed some equipment. The following information provides the details of the losses Alan suffered from the tornado.  How much loss from the tornado can he deduct on his tax return for the current year?

How much loss from the tornado can he deduct on his tax return for the current year?

Definitions:

Water Retention

The accumulation of excess fluids in the body tissues, often leading to swelling.

Nonparents

Individuals who do not have children, either by choice or circumstance.

Child-Free

Individuals or couples who choose not to have children.

Infertile

The inability to conceive a child after a year or more of regular sexual intercourse without the use of birth control.

Q24: Discuss the limitations of the lifetime learning

Q29: Ruth, who files as head of household,

Q34: There are two types of primary tax

Q65: Deductible education expenses include all of the

Q68: The amount of the standard deduction increases

Q92: Which of the following entity(ies) is(are) considered

Q98: Which of the following is not considered

Q103: Morris redeemed $6,000 (principal of $4,500 and

Q114: The adjusted gross income limitation on casualty

Q116: Even though the taxpayer is claimed as