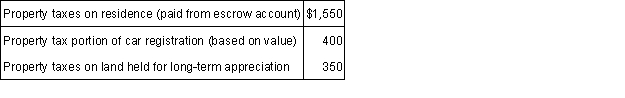

During 2015, Sam paid the following taxes:  What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

Definitions:

Mixing Machines

Equipment used in various industries such as manufacturing and baking to combine ingredients or materials.

Maximize Net Operating Income

The objective to increase the difference between operating revenues and operating expenses, enhancing a business's profitability from its core operations.

Fixed Manufacturing Overhead

Consists of manufacturing costs that do not vary with the level of production, such as salaries of supervisors and rent of the factory.

Predetermined Overhead Rate

An estimated overhead rate used to assign expected overhead costs to individual units of production, aiding in budgeting and cost control.

Q1: The amount realized from a sale or

Q38: Sade, who is single and self-employed as

Q39: The amount of foreign tax credit is

Q44: Jake earned $15,000 and paid $1,500 of

Q57: Employer contributions to fund an eligible Health

Q77: Samantha is a full-time author and recently

Q95: What is the amount of the standard

Q100: A married couple can file a joint

Q102: The qualified tuition and fees deduction is

Q110: The maximum amount per year of dependent