The following are transactions of the Morrison Company:

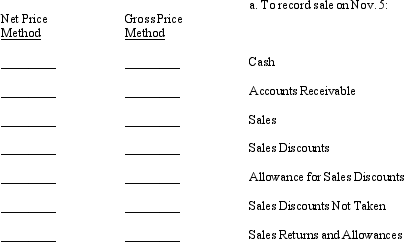

a.On November 5, sold merchandise on account for $46,000 with terms of 3/15, n/30.

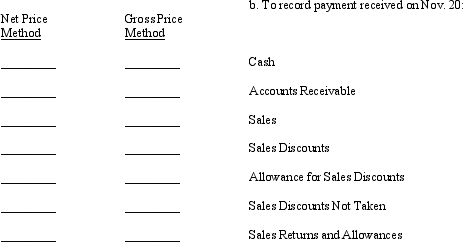

b.On November 20, payment was received on $32,000 worth of merchandise sold on November 5.

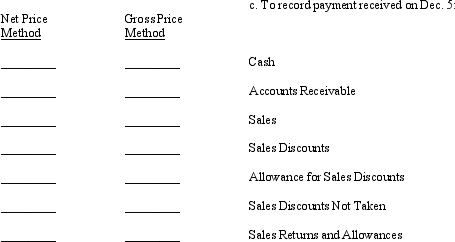

c.On December 5, further collections were made on $8,000 of merchandise sold on November 5.

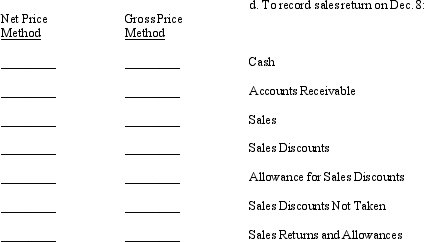

d.On December 8, merchandise sold for $4,000 on November 5 was returned by the purchaser and credit was granted by Morrison Company. Required:

Record the appropriate amounts under the gross price and net price methods in the spaces below. For each method, write the amount to be debited or credited on the appropriate line for each account shown. Indicate that the amount is a debit or credit by placing a (d) or (c) after the amount.

Definitions:

Multiple Facilities

Organizations or establishments having several physical locations or amenities designed for specific functions or services.

Webinars

Online seminars that allow for interactive participation and are designed to educate or inform a remote audience.

Telepresence

Technology that allows a person to feel as if they are present, to give the appearance of being present, or to have an effect, at a location other than their own.

Team Meeting

A gathering of team members to coordinate actions, share updates, and strategize on projects, essentially a synonym for Group Meetings.

Q20: All of the following are necessary components

Q25: Under GAAP for segment reporting, a company

Q29: Which is a component of shareholders' equity?<br>A)

Q36: Current liabilities are obligations whose liquidation is

Q44: The following are transactions of the Morrison

Q61: The accountant for Ella Company made the

Q76: According to current GAAP, which of the

Q123: Prospective adjustments are expected to<br>A) impact financial

Q124: Figure APC-2 is the condensed worksheet for

Q137: Refer to Exhibit 5-2. Compute operating margin