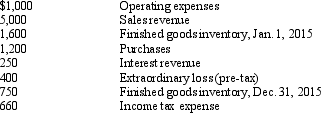

Below are selected accounts taken from the adjusted trial balance of Sherri's Designs on December 31, 2015:

Sherri’s Designs has 2,000 shares of common stock outstanding and net income per share for 2015 was $0.63. The income tax rate is 30%.

a.Prepare a single-step income statement.

b.Prepare a multiple-step income statement.

Definitions:

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products or job orders, based on estimated costs and activity levels.

Machine Hours

A measure of production activity or cost allocation based on the number of hours a machine is operated.

Overapplied Overhead

Refers to the situation where the allocated overhead cost is more than the actual overhead incurred by a business.

Predetermined Overhead Rate

An estimated rate used to assign overhead costs to products or services based on a specific activity base.

Q18: A reader might find information about gain

Q19: The accountant for the Daneen Company made

Q29: Which of the following is an economic

Q32: On April 1, 2014, Miller Company paid

Q90: The mandatory adoption of a new accounting

Q101: All of the following are nontrade receivables

Q106: An advantage of retrospective adjustment method is

Q107: Dollar-value LIFO uses<br>A) current cost only<br>B) cost

Q120: Which one of the following statements is

Q144: The basic purpose of a trial balance