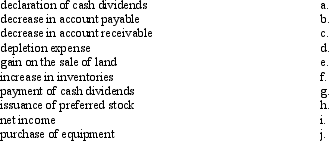

The following are several transactions and events that might be disclosed on a company's statement of cash flows:

Required:

Identify in which section (if any) of the statement of cash flows each of the preceding items would appear and indicate whether it would be an inflow (addition) or outflow (subtraction).

Definitions:

Canada Revenue Agency

The federal agency responsible for administering tax laws and various social and economic benefit and incentive programs delivered through the tax system in Canada.

Tax Exempt

Describes income, property, or transactions that are legally free from tax liability.

Common Equity

The amount of ownership in a corporation that is held by common shareholders, represented by the value of common stock plus retained earnings.

Year-end Balance Sheets

Financial statements detailing a company's assets, liabilities, and equity at the end of a fiscal year.

Q1: When a lessee makes periodic cash payments

Q6: Depreciation expense will be recorded in the

Q11: Which of the following adjusting entries would

Q64: On January 1, 2014, Donna Company leased

Q70: When cash is debited for rents that

Q71: The Joseph, Inc. uses the accrual basis

Q114: Shelley Construction began operations in 2014 and

Q120: What are the two methods for reporting

Q131: What is the purpose of the worksheet?

Q132: Which statement is false?<br>A) The general journal