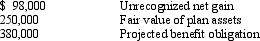

Robin Co. has a defined benefit pension plan that has experienced differences between its expected and actual projected benefit obligation. Data on the plan as of January 1, 2014, follow:

There was no difference between the company's expected and actual return on plan assets during 2014. The average remaining service life of the company's employees is 12 years.

Required:

Determine the amount of the net gain or loss to be included in pension expense for 2014 and indicate whether it is an increase or decrease in the pension expense calculation.

Definitions:

Break-Even

The point at which total costs equal total revenue, resulting in neither profit nor loss.

Sales Dollars

The total monetary amount received from selling goods or services before any deductions are made.

Absorption Costing

An accounting method that includes all manufacturing costs, both variable and fixed, in the calculation of the cost per unit of goods produced.

Variable Costing

A cost accounting method that includes only variable production costs (direct labor, direct materials, and variable manufacturing overhead) in product costs.

Q7: If consolidated statements are presented for the

Q9: Refer to Exhibit 21-3. Net cash provided

Q16: Pruett Corporation began operations in 2013

Q38: During 2014, Stewart, Inc. had the following

Q46: As of December 31, 2015, the Russell

Q60: Teresa Company had the following information related

Q82: Vested benefits are<br>A) estimated benefits<br>B) not contingent

Q83: The content of the statement of cash

Q91: Accounting principles for defined benefit pension plans

Q92: Postemployment benefits are provided to former employees<br>A)