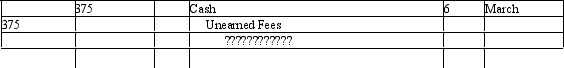

What is the best explanation for this journal entry?

What is the best explanation for this journal entry?

Definitions:

Tax Shifting

The transfer of the burden of a tax from the entity legally responsible for paying it to another party, often consumers, through higher prices.

Tax Evasion

The illegal practice of not paying taxes by not reporting income, reporting expenses not legally allowed, or by not paying taxes owed.

Corporate Profits Tax

A tax imposed on the income or profit earned by corporations.

Equilibrium

A state of balance or stability within a system, where all forces acting upon the system are equal and opposite, leading to no net change.

Q4: A chart of accounts is<br>A) the same

Q16: Unusual items affecting the prior period's income

Q17: Which of the following below increases cash?<br>A)

Q36: An investor purchased 500 shares of common

Q77: A company can use comparisons of its

Q85: All companies must use a calendar year

Q89: What is the proper adjusting entry at

Q107: The dividend yield rate is equal to

Q138: An example of deferred revenue is Unearned

Q210: In which of the following types of