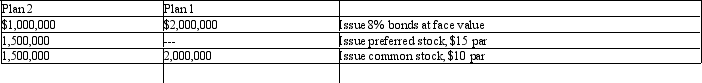

Ulmer Company is considering the following alternative financing plans:

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Required: Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Definitions:

Debt-to-Equity Ratio

A measure of a company's financial leverage, calculated by dividing its total liabilities by stockholders' equity.

Year 2

Typically refers to the second year in a designated time frame, often used in financial and performance analysis.

Times Interest Earned Ratio

A financial metric that measures a company’s ability to meet its interest obligations based on its current earnings before interest and taxes.

Equity Multiplier

A financial leverage ratio that measures the portion of a company’s assets that are financed by its shareholders' equity.

Q33: The main objective of a not-for-profit business

Q51: Which of the following should be deducted

Q62: Bonds Payable has a balance of $900,000

Q66: Free cash flow is cash flow from

Q85: Which of the following is a manufacturing

Q112: On February 1 of the current year,

Q123: The method of accounting for investments in

Q129: A corporation is a separate entity for

Q142: A loan in which the lender deducts

Q148: The following selected data were taken from