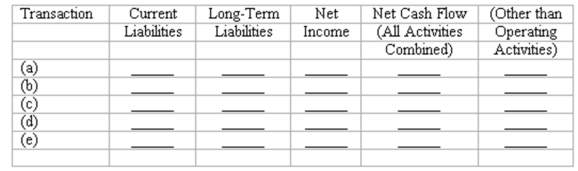

Effects of transactions upon financial measurements

Five events relating to liabilities are described below:

(a) Recorded a bi-weekly payroll, including the issuance of paychecks to employees. Amounts withheld from employees' pay and payroll taxes will be forwarded to appropriate agencies in the near future. (Ignore postretirement costs.)

(b) Made a monthly payment on a 12-month installment note payable, including interest and a partial repayment of the principal amount.

(c) Shortly before the maturity date of a six-month bank loan, made arrangements with the bank to refinance the loan on a long-term basis.

(d) Made an adjusting entry to record accrued interest payable on a 2-year bank loan (interest is paid monthly.)

(e) Made a year-end adjusting entry to amortize a portion of the discount on long-term bonds payable.

Indicate the immediate effects of each transaction or adjusting entry upon the financial measurements in the five column headings listed below. Use the code letters, I for increase, D for decrease, and NE for no effect.

Definitions:

Contribution Margin

The amount remaining from sales revenue after variable expenses have been deducted, indicating how much contributes to the fixed costs and profits.

Scatter Diagram

A graph used in statistics to visually display and assess the possible relationship between two numerical variables.

Visual Line Fit

A method in statistical analysis where a line is visually fitted to a set of data points to assess a potential relationship.

Scatter Diagrams

are graphical representations used in statistics to show the relationship between two variables, displaying data points on a two-dimensional plot.

Q12: Refer to the information above. How many

Q48: Stock splits:<br>A) Allow management to conserve cash.<br>B)

Q86: There is a tax advantage for a

Q121: Employees' annual "take-home-pay," totals approximately:<br>A) $672,300.<br>B) $762,300.<br>C)

Q128: When preparing a bank reconciliation, deposits in

Q130: Effects of errors in inventory valuation<br>Show the

Q146: Preferred stockholders generally do not have the

Q163: Interest payable on a loan becomes a

Q168: Sinking funds usually appear on the balance

Q197: The amortization of a bond discount:<br>A) Decreases