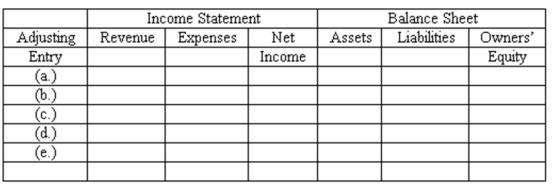

Adjusting entries-effect on elements of financial statements

Whoop-It-Up, Inc. prepares monthly financial statements. On March 31, the company's accountant made adjusting entries to record:

(A) Depreciation for the month of March.

(B) Amount owed to Whoop-It-Up, Inc for March from the concessionaire operating a juice bar in the facility. The amount due will be remitted to Whoop-It-Up, Inc during the first week in April.

(C) Cost of supplies used in March. (When purchased, the cost of supplies is debited to an asset account.)

(D) Earning of a portion of annual membership fees which had been collected in advance. (When customers purchase annual memberships, an Unearned Revenue account is credited.)

(E) Accrued interest for March owed on a bank loan obtained March 1. No interest expense has yet been recorded.

Indicate the effect of each of these adjusting entries on the major elements of the company's financial statements-that is, on revenue, expenses, net income, assets, liabilities, and owner's equity. Organize your answer in tabular form, using the column headings shown below and the symbols + for increase, - for decrease, and NE for no effect.

Definitions:

Economic

Pertaining to the production, consumption, and transfer of wealth in a society, often analyzed in terms of economies of scale, market trends, and financial health.

Philanthropic

Related to the act of donating money, goods, services, and time to support the welfare of others or contribute to the public good, often through charities or nonprofit organizations.

Corporate Social Responsibility

A business model that helps a company be socially accountable—to itself, its stakeholders, and the public—by practicing sustainable business practices and ethical standards.

Social Principles

Fundamental guidelines or norms that dictate behavior within a society, often reflecting the collective ethos or values of a community.

Q8: How much depreciation expense should be recognized

Q12: Presented below is the balance sheet for

Q27: Completion of worksheet--missing data<br>Certain data are given

Q39: The credit side of an account is

Q53: Green Systems sold and delivered modems to

Q78: Net income is:<br>A) The excess of debits

Q78: As of January 31, Princess Company owes

Q80: The adjusted trial balance contains income statement

Q151: Indicate all of the following statements that

Q158: Assuming Dynamic, Inc. uses the income statement